Debt Management: How to Prioritize and Repay Loans Effectively

Snowball vs. Avalanche Methods Explained

Debt is often an unavoidable part of life—whether it’s to finance a home, pursue education, or handle unforeseen emergencies. However, the key to financial stability lies not in avoiding debt entirely but in managing it effectively. Mismanaged debt can lead to financial stress, reduced creditworthiness, and strained cash flow. To navigate your obligations and repay loans efficiently, a well-structured plan is essential.

Understanding Tax Deductions for Salaried Employees: A Comprehensive Guide to Maximizing Savings

For salaried employees in India, understanding tax deductions is crucial for reducing taxable income effectively. With the introduction of the new tax regime (under Section 115BAC), taxpayers now have the option to forgo certain deductions in favor of lower tax rates. Here, we’ll explore both widely known and lesser-known deductions under the old tax re…

Understanding Your Debt Landscape

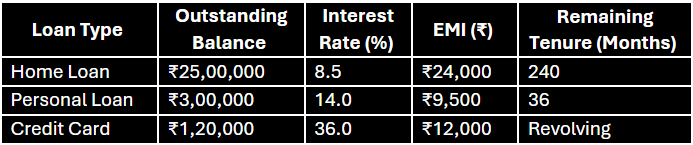

The first step in effective debt management is to fully understand your debt portfolio. Make a comprehensive list of all your debts. This includes the loan type (e.g., home loan, car loan, personal loan, credit card), the outstanding balance, the interest rate, the repayment tenure, and the monthly EMI. Here's an example of how to structure your analysis:

This table provides clarity on where your money is going, which loans are costing you the most, and which ones require immediate attention.

The Art of Prioritization

Not all loans are created equal, and they should not be treated as such. High-interest loans, such as credit card debt and personal loans, should be your top priority. These loans accrue interest rapidly, significantly increasing the total cost over time. On the other hand, secured loans, like home loans, typically carry lower interest rates and offer collateral-backed security to the lender, making them less urgent to pay off.

However, there’s more to prioritization than just interest rates. Loans with tax benefits, such as home loans (under Section 24(b)) and education loans (under Section 80E), can also be deprioritized to some extent because they reduce your taxable income, offering indirect savings.

Choosing the Right Repayment Strategy

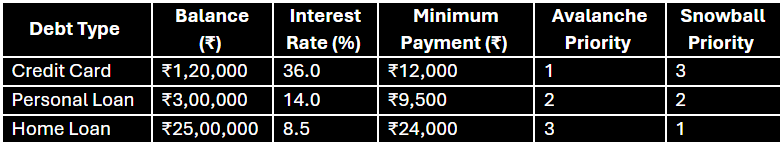

Once you have a clear understanding of your debt portfolio, the next step is to choose a repayment strategy. Two popular methods often debated are the Debt Snowball Method and the Debt Avalanche Method.

The Debt Snowball Method focuses on clearing the smallest balances first. While it may not save the most on interest, it provides psychological wins that keep you motivated.

The Debt Avalanche Method, on the other hand, targets the highest-interest loans first, ensuring maximum savings over the long term.

🎙️ Love what you’re reading? Join the Conversation on Wallet Wisdom!

Take your understanding to the next level. In The Podcast, we explore Freelance, Side Hustles, and Passive Income: Earning Beyond Your Salary, share expert insights, example of our Reader and answer your burning questions.Here’s a comparative example:

The Avalanche Method would save you the most in interest over time, but the Snowball Method may feel more rewarding due to faster loan closures. The choice depends on your financial behavior and discipline.

Budgeting for Debt Repayment

Creating and sticking to a budget is crucial. Begin by calculating your monthly income and subtracting fixed expenses such as rent, utilities, and groceries. Allocate a portion of the remaining amount to your debt repayment strategy. Ideally, aim for at least 20%-30% of your net income to go toward debt clearance.

For example, if your monthly income is ₹80,000 and your fixed expenses are ₹40,000, try allocating ₹16,000-₹24,000 toward loan repayment. This disciplined approach ensures you stay on track while avoiding unnecessary financial strain.

Avoiding Common Pitfalls

One of the biggest mistakes borrowers make is missing payments, which leads to penalties, a lower credit score, and increased interest charges. Automating EMI payments can help you stay consistent and avoid late fees. Additionally, refrain from over-reliance on credit cards, especially for non-essential expenses. Credit card interest rates can soar as high as 36%, and carrying forward balances can quickly spiral out of control.

Another common misstep is neglecting loan terms. Some loans, particularly secured ones like home loans, may impose prepayment penalties. Always review your loan agreement before making additional payments to avoid unexpected charges.

Considering Consolidation or Refinancing

Debt consolidation involves combining multiple loans into a single one, usually at a lower interest rate. For instance, if you have several credit card balances, you could consolidate them with a personal loan offering a more affordable rate. Similarly, refinancing can help reduce the cost of existing loans. For example, refinancing a home loan at 7.5% instead of 8.5% can save significant interest over a 20-year tenure.

Embracing Financial Discipline

Debt repayment requires a high degree of financial discipline. Here are some actionable tips:

Pay More Than the Minimum: Small additional payments reduce both the principal and interest burden.

Utilize Windfalls Wisely: Bonuses, tax refunds, or unexpected income should be directed toward loan repayment.

Build an Emergency Fund: Set aside 3-6 months' worth of expenses to avoid new debt in case of emergencies.

Avoid Lifestyle Inflation: Resist the temptation to increase spending as your income grows; prioritize debt clearance instead.

The Psychological and Financial Benefits of Being Debt-Free

Becoming debt-free offers not just financial relief but also peace of mind. Without the burden of debt, you can redirect your income toward wealth-building goals such as investments, retirement planning, or starting a business. It also improves your credit score, enabling you to access favorable terms for future borrowing needs, if any.

Debt management is a journey that requires planning, patience, and persistence. By understanding your loans, prioritizing repayments, and adopting sound strategies, you can achieve financial freedom sooner than you think. If you need tailored advice or assistance, Varish Partners offers expert financial planning services to help you create a roadmap for debt repayment and long-term financial health.